It’s the last year of the decade! Happy New Year! In a few moments, we leave the 2010s and enter the 20s. And so I’m taking a few moments for a bit of introspection about the year just past and prognostication about the year to come.

But first, what happened over the last decade, in a paragraph? Most of my 30s has been spent in this decade. In the first half, I spent a lot of time doing two things: working and traveling. The happy confluence of discovering travel hacking and being of the age where friends were getting married meant I got to attend weddings in 10 countries! The second half of the decade was far more personally eventful: some big life milestones (mortgagee, started a family), 3 startups (sold one, left one, still working on one), did some legal consulting with a bunch of clients, and ended up going full time employed with one. The second half was also significantly more stressful.

2019

Travels. We took a trip in February to catch up with our extended family in Singapore and Copenhagen, with a side trip to Bali where we stayed at the amazing Amankila. While in Copenhagen, I also managed to squeeze a quick side trip to London, Helsinki and Tallinn. Domestically, we spent a weekend in San Diego for Susanne’s birthday, and some time in Palm Springs with Susanne’s parents for a break. Later in the year, we all went back to Copenhagen for Susanne’s dad’s 70th birthday. Work trips were unusually varied. A crazy deal took Susanne to Montreal twice, and Stuart went to Taipei, Kaoshiung, Sydney and Kyiv.

Work. Susanne had her highest billing month this year. I started a new job at Pango, which is a small company headquartered in Redwood City that sells products to protect consumer privacy and security, including a VPN product that has hundreds of millions of users. I continue to help out with Aerofiler, and the company landed its first 10 customers this year. We exhibited at CLOC Sydney and the Sydney-based team visited Silicon Valley as a part of UNSW’s 10x program.

2020

Politics. Some predictions:

- Brexit: It’s coming January 31, 2020, this time for sure. Boris has a mandate (strong conviction).

- Impeachment: Trump will be acquitted by the Senate (absolute conviction).

- Democratic Presidential Candidate: Biden, probably (weak conviction).

- US Presidential Election: Trump gets re-elected (medium conviction).

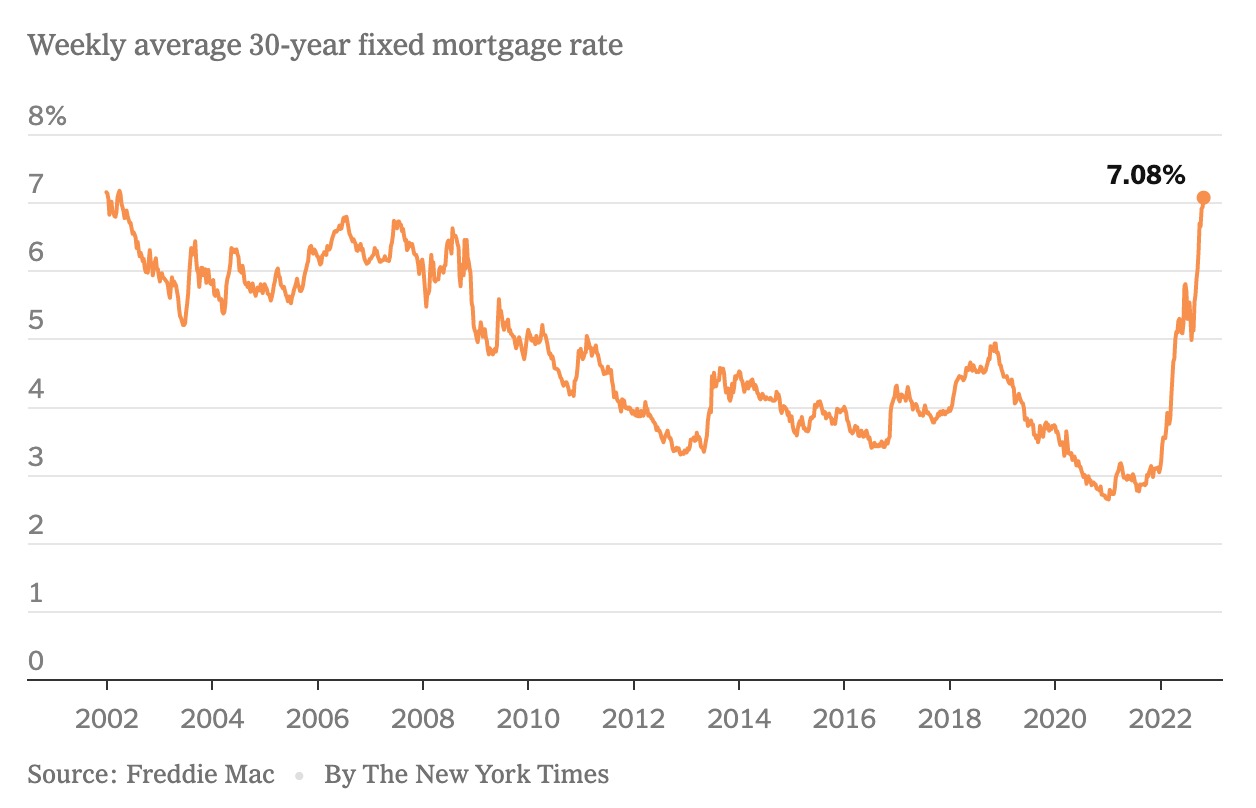

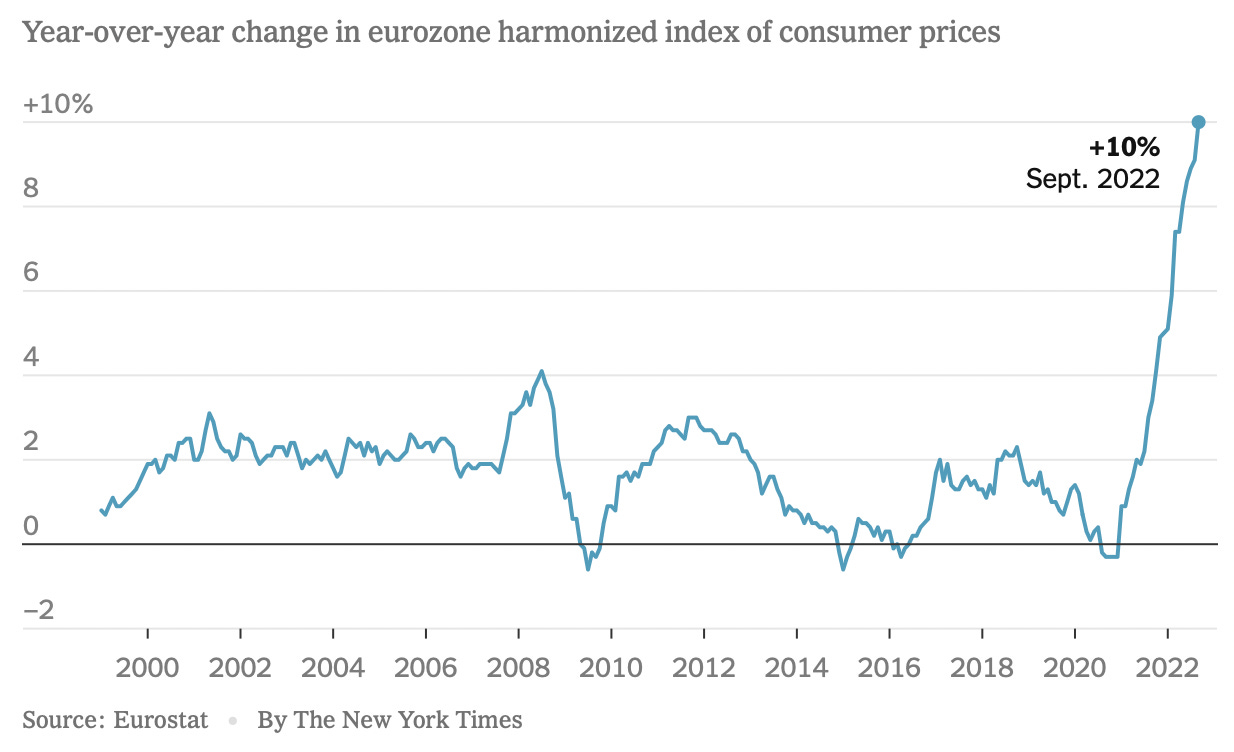

The Economy. The low interest rate environment continues along with asset price inflation. Global debt continues to build, growing a massive powder keg that is in search of a spark. A spark could come in the form of increased interests rates, but central banks have little appetite to be hawkish. Wealth inequality will keep CPI low (all the inflation is in boomer assets and bananas duct-taped to walls, not wage growth for the blue collar worker, despite generationally-low employment rates). All this suggests that low interest rates are here to stay for a long time yet. Trump will try to juice the economy as much as he can to keep it going through to the election. There’s always the chance of a blow up somewhere in the world catalyzing a global crash, but it’s hard to see what that will be at this time (but I guess it always is).

Inequality. The growing wealth inequality continues, and I don’t see any way the trend reverses, short of social unrest and dramatical changes in the political landscape. One pedestrian example of how the gap between the haves and have nots increases: We were doing the maths on owning versus renting a house here, and if you consider the costs of home ownership (mortgage interest, homeowner’s insurance, and property tax), due to the tax deductibility of mortgage interest, we’re only paying slightly more for our house than the 2-bed 1-bath apartment we were renting a few years ago (and rents have since gone up). Additionally, mortgage principal repayments are a form of forced saving, and exposure to capital appreciation has been good in the current economic climate.

Real Estate. I’m expecting the Bay Area market to continue treading water. After 2019’s spate of IPOs, property prices haven’t really moved. The media has reported a bunch of IPOs bombing, but it’s all relative. A bunch of people still made millions – just not as many millions. Except for the poor sods at WeWork not named Adam Neumann. As to which, see the inequality point above.

In the meantime, Denmark’s residential mortgage rates (as low as -0.5%) tempted me to take a look into the Copenhagen market. It turns out that Denmark is pretty xenophobic and that it’s pretty tough to own property unless you know how to properly pronounce the word “hvad”. Luckily, I have access to such an individual, but she thinks that everything is too expensive. I reminded her that I thought property in Menlo Park was too expensive for the last 7 years and look where my prognosticating got us. Not in Menlo Park.

Tech. The IPO I’m most anticipating in 2020 is Airbnb. Assuming their financials hold up (they spent a lot of money on marketing in their last leaked financials), I don’t think the WeWork debacle and Uber disappointment will act as a drag. They’re meant to be profitable or at least profit-able (excluding stock-based comp, which is somewhat misleading but par for the course for private companies around here).

Privacy. Will continue to get a lot of scrutiny and Facebook will continue to be a punching bag. Their reputation when it comes to privacy has been in the muck for some time now. But as always, people will complain, and then keep using it. I think that’s going to be true with any service that has a lot of utility – privacy is a theoretical issue, but your ability to see photos of your friends in exotic locations, the latest Trump tweet, or memes provide an immediate shot of dopamine (or maybe just a dose of FOMO) that just steamrolls it. Indeed, Facebook’s stock is at a high, so they’re continuing to make more money in spite of all that has happened. The only way that changes is that the government breaks it up.

On the privacy regulation front, I’ve been a bit skeptical ever since Ashley Madison happened. The absolute nuclear event for a privacy lawyer is a security breach where all your customer data is exposed to the public. Ashley Madison is a site for people who want to have affairs. They experienced that nuclear event in 2015. Real names, home addresses, search history, and credit card information were all exposed. 60 gigabytes of it (granted, most of it was fake accounts). All of it obviously extremely sensitive. People reportedly committed suicide over the leak. This should have shut them down for good, but the site settled its lawsuits is still alive today. I don’t think that the privacy laws that have been passed in Europe and California since would have changed this much.

We have Alexa, Siri, Google, and Cortana in our homes – always listening. We use devices (mobile phones, cars) that let people we don’t know, know where we are 24/7. No one really seems to care. I mean, truly care. Of course, everyone talks about it, but no one really does much about it.