Weekly Report: March 5, 2023

Observations

Berkshire Annual Report

Warren Buffett’s annual shareholder letter was published as part of Berkshire Hathaway’s annual report last week. This year’s was quite brief, but as usual, very accessible and a repeated reminder of the simple themes that have served him well over the decades.

- After the growthy period of 2019-2021, Berkshire returned to outperforming the S&P index, returning 4.0% in a year where the market fell 18.1%.

- “We are understanding about business mistakes; our tolerance for personal misconduct is zero.”

- Berkshire buys businesses and also invests in public companies with the expectation of holding each indefinitely and therefore looks for enduring businesses with trustworthy managers. He notes that private, controlled businesses are almost never available at bargain valuations.

- He notes that they make, on average, one “truly good” decision every 5 years, and that the performance of their portfolio of businesses includes “a large group that are marginal” but many that are “very good” and a few that are “truly extraordinary”.

- For example, he highlights the performance of a 28-year holding of Coca-Cola. Cost base was $1.3B. As of 2022, it threw of $704M in cash dividends (53% annual yield on the original investment!) with a market value of $25B (19x capital gain).Put another way, if my parents had invested $100k in Coke when I was in primary school, that investment would today be almost $2M and generating $53k in dividends. Makes me think about what I should do for my kids to leverage the power of compounding. They are each currently, as Morgan Housel puts it, “time billionaires”.

- Last year, Berkshire acquired another property-casualty insurer, growing its insurance float from $147B to $164M (the premiums it holds).

- Berkshire holds a “boatload of cash and U.S. Treasury bills” and avoids behavior that could result in uncomfortable cash needs at inconvenient times, including financial panics and unprecedented insurance losses. Seems like a good personal approach too.

- He rails against the politicization of stock buybacks. As a pure matter of mathematics, stock buybacks, when performed at a good (undervalued) price, are beneficial to all remaining shareholders.

- His formula: retaining earnings in its businesses (Berkshire doesn’t pay dividends) + compounding + avoiding major mistakes + what he calls the American Tailwind: “America would have done fine withour Berkshire. The reverse is not true.”

- Berkshire’s annual corporate tax bill of $31B is 0.1% of the entire American tax base.

- He shares a bullet point list of some things Charlie Munger said on a podcast, including the value of being a patient, long-term investor, the dangers of leverage in wealth destruction, that you “don’t need to own a lot of things to get rich”, and that investing requires adapting as the world changes.

- In reference to Charlie Munger: “Find a very smart high-grade partner — preferably slightly older than you — and then listen very carefully to what he says.”

Phones at Work

When I was younger, I generally disliked talking on the phone (there was a measure of anxiety attached to it), so the advent of SMS, emails, and IMs felt like a blessing to me, and more so as the younger generations pushed adoption of that socially, and then in the workplace. However, especially in tech workplaces, I now find myself missing phone calls.

To contact someone now, people typically reach out via Slack and then wait. Or schedule some time on their calendar and then wait. Or if it’s really urgent, they’ll send a text and then wait. It’s less intrusive, but also there’s no way to guarantee a quick answer for small things — even if the person is completely available, they just might not see your message for a while. And for a lot of these calls you simply don’t need video. You just need to get some shit done.

When I was a junior lawyer at a firm, we had these Cisco IP phones on our desk. People would just dial each other up by punching in 4 digit extensions. It was spontaneous, marvelously tactile, and it wasn’t a big deal. If the other person was unavailable (in a meeting, on another call, or just under the gun getting something out), they would ignore the call or send it to voicemail. (And if it was super urgent and you weren’t answering, they would physically show up at your door.) No one really worried about interrupting anyone. Clients would call out of the blue as well.

For a period I had an office next door to my supervising partner (I still remember his 4-digit extension, 15 years on), and he would still call me despite the physical proximity. I was thankful that he didn’t scream through the wall, even though that would have been marginally quicker.

These calls were a great way to deal with things in a minute that can now take quite a lot of minutes and relative effort to resolve over chat. Also, it’s a great way to ask a bunch of questions in a way that feels natural but, when done over a textual medium, can feel interrogational and even aggressive.

No one does this anymore, and I think you lose a valuable communication method and tool.

Further Observations

- This week I learned that the U.S. Supreme Court opens each term with the pronouncement “Oyez, oyez, oyez!” Oyez is an Anglo-Norman word that means “Hear Ye!” It’s kind of weird that it took me so long to learn that given that I work in law and also started a blog called Hear Ye! over 20 years ago.

- A 15-lawyer Canadian litigation law firm tried the 4-day work week for 2 years and published its results (Wednesday was their off day). They are pragmatic and interesting:

- “Sometimes you’d have to work 5, 6, or 7 days a week and that is OK; that’s just life.” In other words, at a normal law firm you sometimes have to work weekends. In this case, the weekend is 3 days long, and you may have to work weekends. Particularly since clients expect availability and the courts have their own schedules. “In my interviews with our lawyers, they said they have had to work at least 1 hour or more on over 50% of Wednesdays.”

- It takes “a lot of planning and thought”.

- “You can attract the wrong crowd by advertising 4-day work weeks and need to get your message right and clear.” They put in a 3 month probationary period that requires new hires to work 5 days in the office until they get an idea of their work ethic.

- “We have way, way less turnover.” This makes sense. And this suggests people chuck sickies quite often: “Our sick day requests have been reduced by over 80%.”

- They still managed to grow revenue over that period (more than 2x over 2 years).

Articles

- There’s a Growing Crisis in Our Social Lives. Is the Cure This Simple? (Slate)

This article was the direct cause for me scheduling a hike next weekend with a friend I haven’t seen (without our kids in tow) since May last year. - The West Lives On in the Taliban’s Afghanistan (Palladium Magazine)

- Silvergate Bank’s slow motion fall (Axios)

- How the Silvergate Bank Turmoil is Impacting the Crypto Markets (video) (Coindesk)

- Update from Andy Jassy on Amazon’s return to office plans (Amazon)

- Even Democrats Like Me Are Fed Up With San Francisco (New York Times)

- The scale of the entire Universe versus the James Webb Space Telescope’s views (Ethan Siegel)

- Should the moon have its own time zone? (NBC News)

- A New Breed of Safaris in Botswana Aims Higher Than Just Animals (Bloomberg)

- The Great Dumpling Drama of Glendale, California (Eater)

Movies & TV

- Drive to Survive (Season 5)

“It’s not a documentary. It’s closer to Top Gun than a documentary.” —Toto Wolff. Great way to whet the appetite for the new F1 season, which started this week!

Charts, Images & Videos

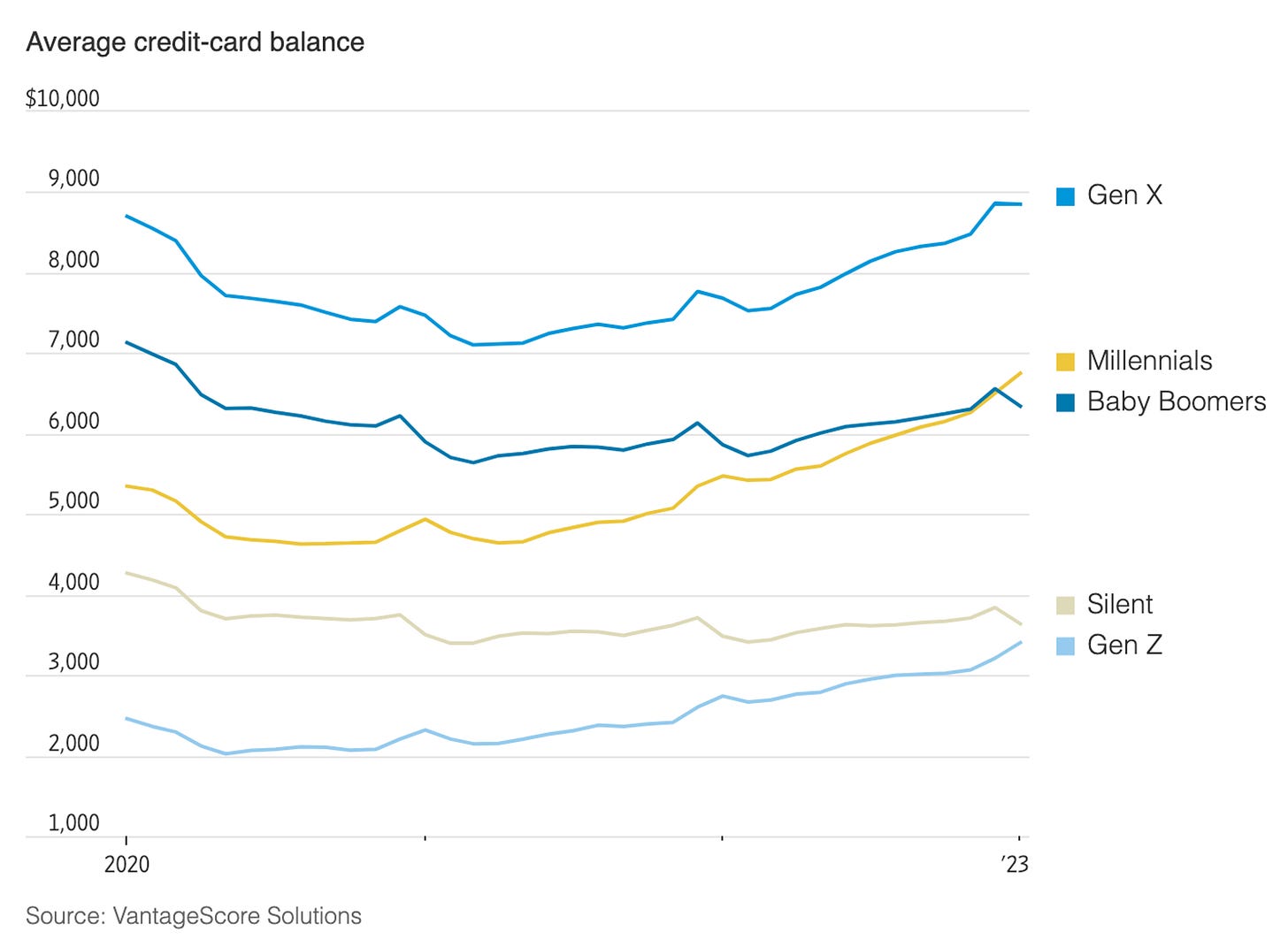

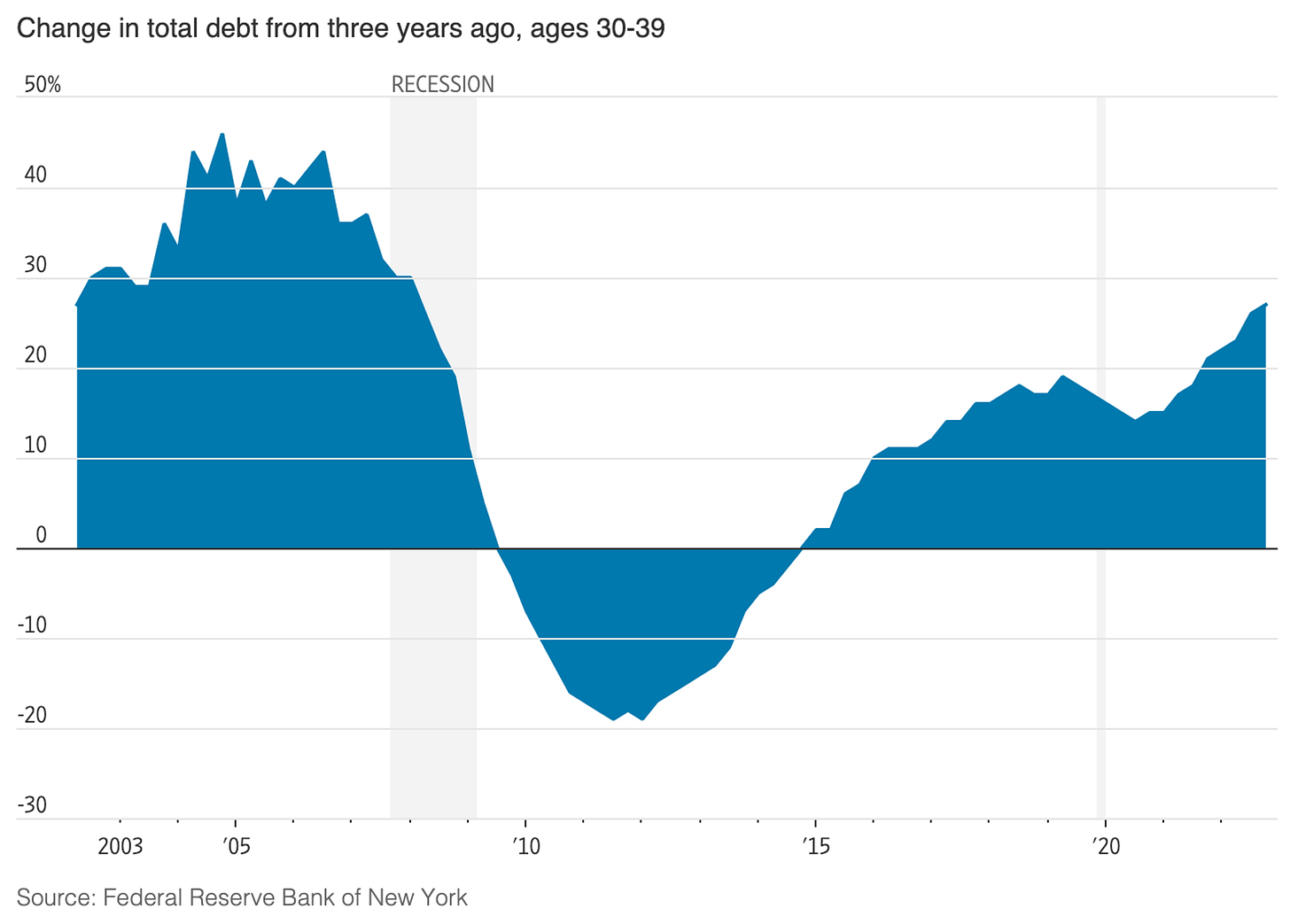

From Americans in Their 30s are Piling On Debt (Wall Street Journal):